Content

By analyzing these numbers, you will be able to see where your business is strong or weak in relation to other companies in similar industries. If there are any areas for improvement (i.e., too much debt), it will allow you time to prepare so that when the unexpected happens. A balance sheet is a financial statement that provides an overview of the company’s assets, liabilities, and equity at a specific point in time. It is important to know what each one means in order to understand how well you’re doing. It can be difficult to understand all the information on this document, but there are ways to break it down into more manageable pieces. A balance sheet helps you determine your business’ liquidity, leverage, and rates of return.

How to Read a Balance Sheet – The Motley Fool

How to Read a Balance Sheet.

Posted: Mon, 11 Apr 2022 20:23:09 GMT [source]

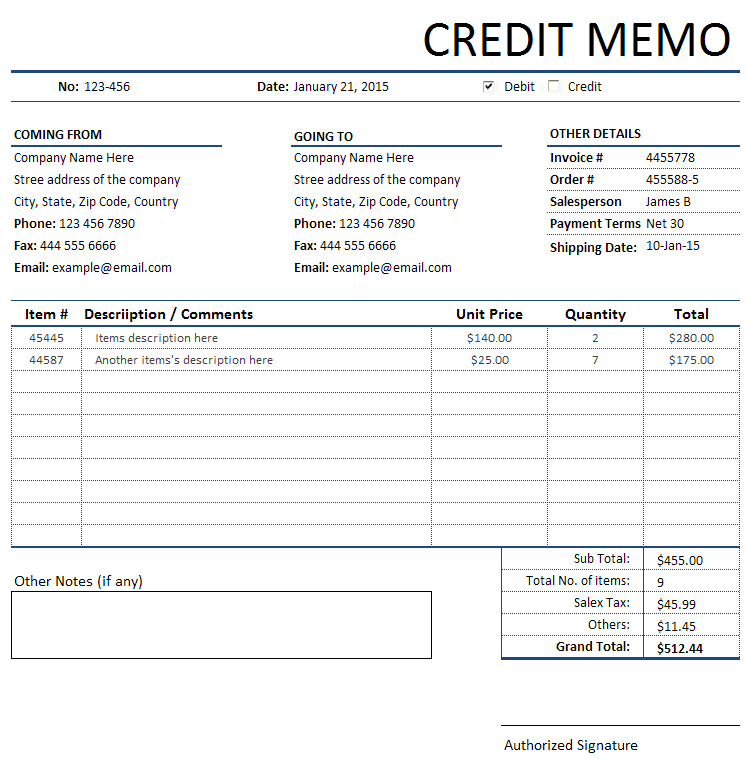

However, in the case of sole proprietorship, and partnership, no rule is provided for recording assets and liabilities on the balance sheet. Dual-aspect—i.e., assets listed on a balance sheet are equal in total to the liabilities and share-holders equity. For example, cash and short-term investments are a store of monetary value and can earn interest while accounts receivable are payments owed by customers that had paid on credit. Financial StatementFinancial statements are written reports prepared by a company’s management to present the company’s financial affairs over a given period . DividendDividends refer to the portion of business earnings paid to the shareholders as gratitude for investing in the company’s equity. Accounts ReceivablesAccounts receivables is the money owed to a business by clients for which the business has given services or delivered a product but has not yet collected payment. They are categorized as current assets on the balance sheet as the payments expected within a year.

Understand Shareholders’ Equity (Owner’s Equity)

An income statement, also called a profit and loss (P&L) statement, lists out a company’s revenue streams and expenses (payroll, operating expenses, etc.) over a given period of time. The Balance Sheet, one of the core financial statements, provides a snapshot of a company’s assets, liabilities and shareholders’ equity at a specific point in time. Hence, the balance sheet is often used interchangeably with the term “statement of financial position”.

The exact accounts on a balance sheet will differ by company and by industry. Liquidity – Comparing a company’s current assets to its current liabilities provides a picture of liquidity. Current assets should be greater than current liabilities, so the company can cover its short-term obligations. The Current Ratio and Quick Ratio are examples of liquidity The Beginners Guide To Balance Sheets financial metrics. Some assets and liabilities are measured on the basis of fair value and some are measured at historical cost. Notes to financial statements provide information that is helpful in assessing the comparability of measurement bases across companies. The balance sheet discloses what an entity owns and what it owes at a specific point in time.

The Beginner’s Guide to Balance Sheets

Intangible assets – Nonphysical assets such as patents, copyrights, licenses, and franchise agreements. Hyper-accurate, up-to-date books that close on time, every time—without the effort. After enrolling in a program, you may request a withdrawal with refund (minus a $100 nonrefundable enrollment fee) up until 24 hours after the start of your program.

- It helps to read the corporate reports and the Form 10-K. The 10-K is required to be filed with the SEC and summarizes financial decisions, internal controls, investment strategies, and much more.

- Financial StatementFinancial statements are written reports prepared by a company’s management to present the company’s financial affairs over a given period .

- The balance sheet distinguishes between current and non-current assets and between current and non-current liabilities unless a presentation based on liquidity provides more relevant and reliable information.

- It is also intended to provide context for the financial statements and information about the company’s earnings and cash flows.

- If a company buys a piece of machinery, the cash flow statement would reflect this activity as a cash outflow from investing activities because it used cash.

The interest income and expense are then added or subtracted from the operating profits to arrive at operating profit before income tax. Moving down the stairs from the net revenue line, there are several lines that represent various kinds of operating expenses. Although these lines can be reported in various orders, the next line after net revenues typically shows the costs of the sales. This number tells you the amount of money the company spent to produce the goods or services it sold during the accounting period.

Why is the balance sheet important?

If you are new to HBS Online, you will be required to set up an account before starting an application for the program of your choice. Harvard Business https://online-accounting.net/ School Online’s Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.